I bought my first house 10 years ago, in July, 1998. Prior to the purchase I was living in a nearby apartment complex, paying $435/month for a 2-bedroom, 1 bath. I (over)paid $86,500 for the house, putting 3% down, so my monthly payments, at roughly $600, were ~35% higher than my rent--a reasonable premium to me, considering I'd suddenly be living and building equity in "my own place."

Today, zillow.com says the house is worth about $192,000, and monthly payments at 3% down would come to just under $1300/month. By comparison, you can still rent that 2 bedroom apartment for around $600. Doing the same math again, I don't think I'd come to the conclusion that the "ownership premium" is really worth it. Would you?

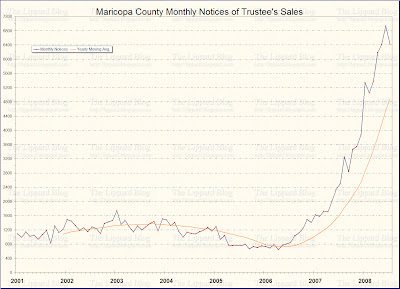

You might be wondering what my little story has to do with July's notices of trustee's sales--which, at 6412, as you can see from the graph, were lower than June's. Bush's housing bailout bill recently became law, which may mean that we have just passed the peak for home foreclosures--and soon we may even see a stop to falling home prices. Great news for current home owners, but, as my personal anecdote suggests, not-so-great news for housing affordability in general. The bailout essentially is a subsidy to current home owners at the expense of future home owners.

Because it will prop up current prices beyond where they would have naturally fallen, housing affordability will remain low, encouraging the spawning of all sorts of new government programs to help address "the affordability gap" (or some such wealth-transfer justificationist nonsense)--making money cheaper than it actually is, which will in turn encourage sellers to raise their prices still further while at the same time creating homeowners out of people who probably aren't fiscally responsible enough to be ones. Is this sounding familiar, yet?

As a non-homeowner who is making twice what he made in 1998 but would have an extremely hard time justifying paying $1300/month to own a crappy house, I would have preferred if Congress could've just left well enough alone.

Real estate ownership is a long term investment. Historically, except during artificially created boom periods, it does not “pencil” over the short term. Buying the property for $86,500, in 1998 at a 35% premium (compared to renting) was not necessarily a mistake, Einzige. Selling it before it went up in value, however, prevented you from getting the best return on your investment. Consider where you might be today if you had kept the property. Even after the recent downturn in property values, your equity in this property (now valued at $192,000) would be about $100,000. As a renter, all you have to show for your trouble is rent receipts. While ownership may temporarily cost a little more than renting on a monthly basis, eventually, inflation in rental rates catches up. Long term, appreciation in the value of the property more than makes up for any short term premium on ownership. This will continue to be true as long as governments keep inflating currencies. I think it is not unreasonable to believe that the time will come when $192,000 will seem to be as low a price for this house as $86,500 does today. The key question is: When is the best time to buy? Your chart helps me in my effort to answer that question. Thanks for that!!

ReplyDeleteGood points, but the numbers mentioned don't include such things as maintenance costs, which do increase yearly, and most certainly negatively affect returns on investment.

ReplyDeleteI think it might also be a safe assumption that the next 10 years will not see a similar run-up in property values in Maricopa County.

This is the first time we've seen a dip to the level of the previous month. I hope we look back at this chart in a few months and see June as the peak for preforeclosures.

ReplyDeleteChristopher wrote: "Long term, appreciation in the value of the property more than makes up for any short term premium on ownership."

ReplyDeleteRobert Shiller's figures shows only about a 1% average annual appreciation for home ownership in real terms, so homes in general are not great as an investment, as opposed to a place to live.

I am not sure I agree with Einzige about inflation in the next ten years being less than in the past ten years. Expansion of the money supply is continuing unabated with no end in sight. The disconnect that occurred in the 1990's between the increasing money supply and the inflation rate cannot continue indefinitely. As worldwide demand for dollars declines, real goods and services (including real estate) are bound to go up in value (as measured in dollars).

ReplyDeleteWhile Robert Shiller may be correct about home ownership in general, I know a great many people (myself included) who have done MUCH better than 1% per year in real terms. Timing is everything!

What you are suggesting, it seems to me, is that I engage in pure speculation--as that is what trying to "time the market" is all about.

ReplyDeleteIf it's safe to assume that real estate is a hedge against inflation, then it's also safe to assume that equities--say in an index fund of REITs, if you're intent on investments in real estate--are a hedge against inflation.

Given that...

1) It's likely that some form of the efficient markets hypothesis holds,

2) I am not possessed of unusual skills or talents related to investment in real estate,

3) Without unusual talents or skills, or doing lots of extra work (an opportunity cost, that should be factored into any ROI calculation) I will have to pay retail price for any property I purchase--a near guarantee against a decent return,

4) There is less risk involved in owning index funds of equities than a single property, and

5) Returns on retirement funds are tax-deferred,

...I believe I am likely better off putting my investment dollars into my IRA and 401k than into a home--at least until I have maximized the allowable contributions.

Your contention that real estate is a "long term investment" is an implicit admission that the typical investment property is, in fact, a guaranteed loser for the first few years, and I remain unconvinced that the returns seen in later years are high enough to offset the initial losses and bring the total returns in line with, e.g., an S&P 500 index fund.

Okay, you win. Homeowners end up in the poorhouse and renters get rich by investing the money they save on mortgage payments in S&P 500 Index funds.

ReplyDeleteChristopher: I think there's a post hoc ergo propter hoc fallacy implicit in your sarcastic comment. The wealthy tend to own their homes and the poor tend to rent, but I don't think I'd infer from that the conclusion that the wealthy have become so because they own their own homes or that the poor have become so because they rent.

ReplyDelete(BTW, this website says that 46% of those in the U.S. below the poverty line own their own homes--but often have difficulty paying for basic repairs, an issue that renters don't have.)

Jim: My previous sarcastic comment was not intended to be an argument at all, implicit or otherwise. It was intended as a joke to emphasize the fact that continuing this argument is a waste of time. Either you accept the notion that real property can be a good long-term hedge against inflation or you don't. I don't have time to debate it. You guys have too much time on your hands!

ReplyDelete"Either you accept the notion that real property can be a good long-term hedge against inflation or you don't."

ReplyDeleteYour phraseology implies that it is, and that one can choose to see this truth or not.

I actually never claimed that owning property wasn't a hedge against inflation. I argued that there are demonstrably better alternatives available. I am reasonably sure that, had I taken all the money I spent on my houses including all costs, such as maintenance, repair, mortgage, management, etc., and put it into my IRA, 401K, and brokerage accounts, in index funds, then today I'd be net ahead of where I would have otherwise been, had I kept the houses.

I would, on the other hand, agree that, absent other forms of asset ownership, you're probably better off owning a house. But at this point I think I'm repeating myself.